The Significance of Bitcoin Halving

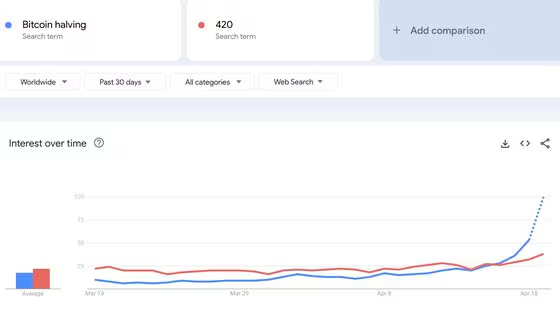

As the countdown to the fourth bitcoin halving continues, the anticipation and excitement among crypto enthusiasts are palpable. The concept of bitcoin halving has become a topic of great interest and discussion in the cryptocurrency community. This event, which occurs approximately every four years, has a significant impact on the bitcoin ecosystem and its value.

Bitcoin Halving and Scarcity

Bitcoin halving is a built-in mechanism that ensures the scarcity of bitcoin over time. It is a fundamental part of the cryptocurrency’s design, intended to control inflation and maintain the value of bitcoin. By reducing the block reward, halving slows down the rate at which new bitcoins are created, ultimately leading to a limited supply.

Historical Precedents and Speculation

Previous halvings have had a profound effect on the price of bitcoin. The first halving in 2012 saw the price surge from around $12 to over $1000 within a year. The second halving in 2016 witnessed an even more dramatic increase, with bitcoin reaching an all-time high of nearly $20,000 in late 2017. These historical precedents have sparked curiosity and speculation about the potential impact of the upcoming halving.

Halving as a Catalyst for a Bull Run

One of the main reasons behind the surge in interest for bitcoin halving is the belief that it could trigger another bull run in the cryptocurrency market. Many investors and traders see halving as a catalyst for price appreciation, as the reduced supply and increased demand could drive up the value of bitcoin. This expectation has led to a flurry of discussions and predictions about the potential price targets and market behavior post-halving.

Macroeconomic Landscape and Bitcoin as a Safe Haven Asset

Furthermore, the current macroeconomic landscape has also contributed to the growing interest in bitcoin halving. With unprecedented levels of government stimulus, concerns about inflation and the devaluation of traditional currencies have intensified. Bitcoin, with its decentralized nature and limited supply, has emerged as an alternative store of value and a hedge against inflation. As a result, more individuals and institutional investors are turning to bitcoin as a potential safe haven asset.

The Fourth Halving and its Broader Implications

While the exact outcome of the upcoming halving remains uncertain, the heightened interest and attention it has garnered are undeniable. As the bitcoin community eagerly awaits the event, discussions about its potential implications and the future of the cryptocurrency market continue to gain momentum. Whether the halving will be a catalyst for a new bull run or result in a more gradual price appreciation, one thing is clear – the bitcoin halving has become a significant event in the crypto world, capturing the attention of both seasoned enthusiasts and newcomers alike.

Impact on Bitcoin Ecosystem and Developer Community

The fourth bitcoin halving is not only significant in terms of its impact on the bitcoin ecosystem but also in relation to the broader financial landscape. One of the key factors contributing to the importance of this halving is the resurging interest in bitcoin as a developer ecosystem. Over the past few years, there has been a noticeable increase in the number of individuals and organizations actively participating in the bitcoin network. This heightened involvement has not only led to technological advancements but has also sparked curiosity and anticipation surrounding the halving event.

Onshoring of the U.S. Mining Industry

Another aspect that adds to the significance of the fourth halving is the recent onshoring of the U.S. mining industry. Following China’s ban on cryptocurrency mining, many mining operations have relocated to the United States. This shift has raised questions about the potential impact on the bitcoin network and the overall decentralization of mining power. With the concentration of mining operations in China being a concern for some time, the onshoring of mining activities in the U.S. brings a new dynamic to the halving event.

Spot Bitcoin ETFs and Market Excitement

Furthermore, the introduction of spot bitcoin ETFs has played a significant role in igniting a market rally and increasing interest in the halving event. These ETFs have made bitcoin investments more accessible to mainstream investors, leading to a surge in demand. While the market rally may be ebbing at the moment, the launch of these ETFs has undoubtedly contributed to the overall excitement surrounding the halving.

Expert Insights on the Fourth Halving

Alex Thorn, the Head of Research at Galaxy Digital, emphasizes the importance of this halving, highlighting its impact on both the market and the supply of bitcoin. He notes that this is the first halving in which major U.S. asset managers are actively educating investors about bitcoin. The halving serves as an excellent educational opportunity for these investors, further solidifying the narrative around the event. Thorn believes that both the narrative and the supply aspect of the halving will have a significant impact on the market.

Security and Decentralization of the Bitcoin Network

Additionally, the bitcoin halving has implications beyond just the price and miners. It also affects the overall security and decentralization of the bitcoin network. The halving event is a key mechanism that ensures the scarcity of bitcoins and prevents inflation.

Competition and Mining Hardware

By reducing the block reward, the halving forces miners to compete for a smaller number of bitcoins. This competition incentivizes miners to invest in more powerful and energy-efficient mining hardware. As a result, the overall computing power of the network increases, making it more secure against potential attacks.

Decentralization and Mining Pools

Moreover, the halving event plays a crucial role in maintaining the decentralization of the bitcoin network. With a reduced block reward, smaller miners may find it challenging to continue mining profitably. This can lead to a consolidation of mining power in the hands of a few large players, potentially compromising the decentralized nature of bitcoin.

Mining Pools and Concentration of Power

To mitigate this centralization risk, some argue that the halving encourages the emergence of mining pools. Mining pools allow individual miners to combine their computing power and share the rewards. This pooling of resources helps smaller miners remain competitive and maintain their participation in the network. However, the rise of mining pools also raises concerns about the concentration of power. Large mining pools can exert significant influence over the network, potentially making decisions that align with their own interests rather than the broader bitcoin community.

The Uncertain Outcome and Various Stakeholders

Overall, the bitcoin halving is a highly anticipated event that has implications for various stakeholders in the cryptocurrency ecosystem. While it is expected to impact the price, miners, security, and decentralization of the network, the exact outcomes are uncertain and subject to the dynamics of the market and the actions of participants.