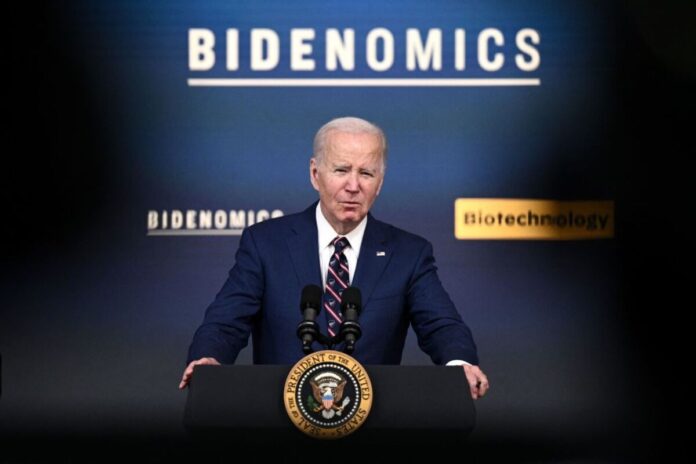

This Week in Bidenomics: The Persistence of Inflation

Inflation has been a persistent concern for the Biden administration, and recent data suggests that it is not going away anytime soon. Despite hopes for a decline in inflation, the latest indicators show that it is reasserting itself in the economy. Personal consumption expenditures, a closely watched measure of inflation by the Federal Reserve, revealed an annualized inflation rate of 2.8% in March, slightly higher than expected. Additionally, the consumer price index, another key indicator, has risen over the past two months and now stands at 3.5%.

The current inflationary trend is a setback for President Biden’s reelection prospects. Inflation had initially peaked at 9% in June 2022 but then fell sharply, reaching a cycle low of 3.1% in June 2023. This decline seemed promising, but inflation has remained stubbornly high, hovering around 3% for the past nine months. This level of inflation is well above the Federal Reserve’s target of 2% and has significant implications for the rest of 2024.

The Impact on Interest Rates and the Economy

If inflation had continued to decline, it would have reached normal levels by now. Investors had anticipated that this tamed inflation would allow the Federal Reserve to cut interest rates in the first half of 2024, providing relief to car and home buyers financing their purchases. However, the current inflationary environment suggests that interest rate cuts may not occur until the fall, or even after the November elections.

While inflation remains a challenge, the overall state of the economy is relatively strong. Consumers are in good financial shape and willing to spend money, which keeps demand robust and prices high. Economic output grew by a 1.6% annualized rate in the first quarter, slightly weaker than expected but still positive. Goldman Sachs has set its target for second-quarter GDP growth at a robust 3.5%, which is promising for President Biden’s reelection prospects.

Most economists believe that the recent surge in inflation will eventually subside. Two categories, auto insurance and rents, are primarily driving the current inflationary pressures. Insurance costs are expected to stabilize, and the calculation for rent inflation may overstate reality as it does not fully account for people signing new leases at lower rates. Additionally, there is minimal inflation in goods, and some products are even becoming cheaper.

However, the Federal Reserve has made it clear that it will not cut interest rates until it is confident that inflation is under control. As a result, interest rates are likely to remain unchanged for several more months and potentially until after the November elections. While interest rates are not at historic highs, they are significantly higher than in recent times, leading many people to question whether they are better off under the Biden administration.

The Impact on Housing and the Stock Market

The persistence of inflation has had a notable impact on the housing market and the stock market. High home values and relatively high financing costs have resulted in mortgage rates hitting new highs and the cost of buying a home reaching an all-time high. These headlines create a perception that the economy may not be as strong as the growth or employment data suggest.

Furthermore, fading hopes for interest rate cuts have disrupted a stock market rally that began in October of the previous year. Investors had been optimistic about the potential for lower interest rates, but the prolonged inflationary environment has dampened these expectations.

In conclusion, inflation remains a significant concern in the Bidenomics landscape. While there are hopes that inflation will eventually subside, the current indicators suggest that it will persist for the foreseeable future. This has implications for interest rates, the housing market, and the stock market. The Biden administration will need to navigate these challenges to maintain economic stability and address the concerns of the American people.