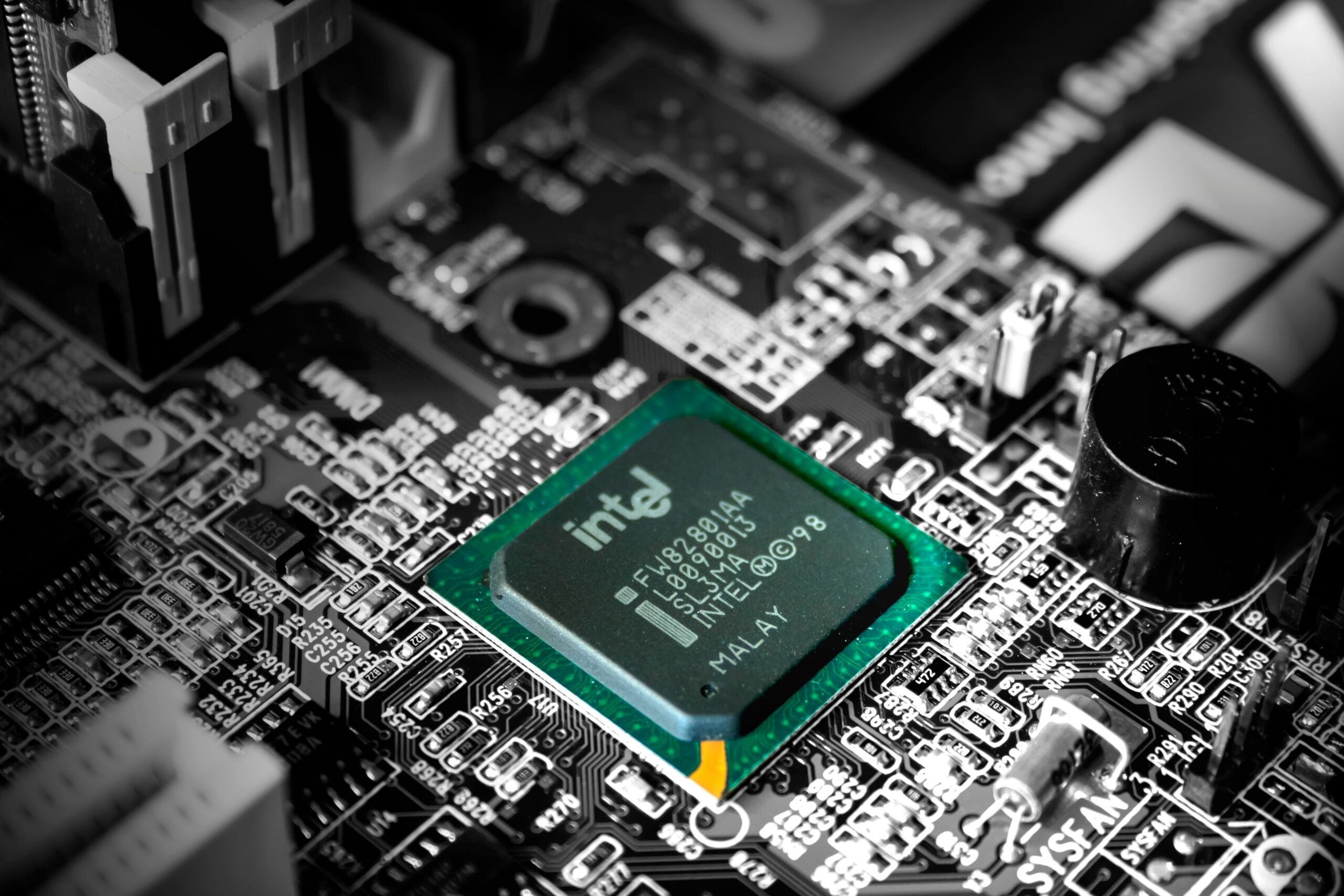

This decline in revenue can be attributed to several factors. Firstly, Intel has been facing stiff competition from TSMC, which has emerged as a major player in the chip manufacturing industry. TSMC has been able to leverage its advanced manufacturing processes and secure contracts with major tech companies, including Apple, Nvidia, and AMD. This has resulted in a loss of market share for Intel, as these companies have increasingly turned to TSMC for their chip production needs.

Furthermore, Intel has been grappling with its own manufacturing challenges. The company has faced delays in transitioning to its 7-nanometer process technology, which has put it at a disadvantage compared to competitors who have already made the switch. This has not only impacted Intel’s ability to deliver cutting-edge chips but has also resulted in increased costs and reduced efficiency in its manufacturing operations.

In addition to these external and internal challenges, the global chip shortage has also had a significant impact on Intel’s performance. The shortage, which has been exacerbated by the COVID-19 pandemic and increased demand for tech products, has led to supply chain disruptions and increased costs for chip manufacturers. This has further strained Intel’s already struggling chip manufacturing division, making it difficult for the company to meet customer demands and generate sufficient revenue.

To address these issues, Intel has announced plans to invest heavily in its manufacturing capabilities. The company aims to regain its technological leadership by accelerating its transition to advanced process nodes and increasing its capacity. Intel has committed to investing $20 billion in two new factories in Arizona, which will focus on the production of advanced semiconductor chips. This investment is expected to create thousands of jobs and help Intel regain its competitive edge in the chip manufacturing industry.

Despite the challenges it currently faces, Intel remains a dominant player in the semiconductor market. The company’s strong brand reputation, extensive intellectual property portfolio, and partnerships with major tech companies provide a solid foundation for its future growth. By addressing its manufacturing issues and capitalizing on emerging opportunities in areas such as artificial intelligence and 5G, Intel has the potential to bounce back and regain its position as a leader in the chip manufacturing industry.

CEO’s Perspective on the Decline

Intel’s CEO, Pat Gelsinger, commented on the company’s decline, stating that he was not surprised by the figures. He attributed the decline to the company’s past strategic mistakes and its dependence on other companies like TSMC for chip manufacturing, which accounted for as much as 30% of their production. This reliance on external manufacturers has put Intel at a disadvantage in the highly competitive market.

Gelsinger emphasized that Intel’s strategic mistakes, particularly in the area of chip manufacturing, have hindered the company’s ability to innovate and meet the growing demand for advanced processors. In recent years, Intel has faced numerous challenges, such as delays in the development of new technologies and increasing competition from rival companies.

To address these issues, Gelsinger outlined a comprehensive plan to revitalize Intel and regain its competitive edge. One of the key aspects of this plan is to invest heavily in the company’s own chip manufacturing capabilities. By reducing its reliance on external manufacturers like TSMC, Intel aims to regain control over its supply chain and ensure a steady stream of high-quality chips.

Furthermore, Gelsinger emphasized the importance of fostering a culture of innovation within Intel. He acknowledged that the company had become complacent in recent years and failed to keep up with the fast-paced advancements in the industry. To rectify this, Intel plans to increase its research and development budget, hire top talent, and foster partnerships with leading technology companies.

In addition to focusing on chip manufacturing and innovation, Gelsinger also stressed the significance of diversifying Intel’s product portfolio. While the company has traditionally been known for its processors, Gelsinger aims to expand into new markets, such as artificial intelligence, autonomous driving, and cloud computing. By diversifying its offerings, Intel can tap into new revenue streams and reduce its reliance on the highly competitive consumer electronics market.

Overall, Gelsinger’s perspective on Intel’s decline highlights the need for a strategic overhaul and a renewed focus on key areas like chip manufacturing, innovation, and diversification. With a comprehensive plan in place, Intel aims to regain its position as a leader in the semiconductor industry and drive sustainable growth in the years to come. Furthermore, Intel’s investment in chip manufacturing factories will not only boost its own production capacity but also contribute to the growth of the semiconductor industry in the United States. The establishment of these factories will create thousands of job opportunities, stimulate local economies, and foster innovation in the field of chip manufacturing.

Moreover, by reducing its reliance on external manufacturers, Intel can have better control over its supply chain, ensuring a steady and uninterrupted flow of chips to meet the increasing global demand. This move comes at a crucial time when the world is experiencing a shortage of semiconductors, affecting various industries such as automotive, consumer electronics, and telecommunications.

In addition to Intel’s initiative, the U.S. government’s support through the CHIPS Act is a significant step towards strengthening domestic semiconductor production. The $8.5 billion fund will enable semiconductor companies to invest in research and development, expand their manufacturing capabilities, and address the ongoing chip shortage. This financial support will not only benefit Intel but also other semiconductor manufacturers in the country, fostering a competitive and resilient industry.

Furthermore, by promoting domestic semiconductor production, the U.S. government aims to reduce its dependence on foreign suppliers, particularly in countries like China, where geopolitical tensions and trade restrictions have raised concerns about the security and reliability of the supply chain. Domestic production will enhance national security and ensure a stable supply of critical components for various sectors, including defense and infrastructure.

Overall, Intel’s investment in chip manufacturing factories and the U.S. government’s support through the CHIPS Act mark a significant milestone in addressing the challenges faced by the semiconductor industry. This collaborative effort will not only strengthen Intel’s position in the market but also boost the domestic semiconductor industry, create job opportunities, enhance supply chain resilience, and contribute to national security. With these strategic initiatives, Intel and the United States are poised to regain their competitiveness in the global semiconductor market and drive innovation in the digital age.

Opinions and Comments

What are your thoughts on Intel’s recent losses and its plans to address the challenges? Do you believe that investing in domestic chip manufacturing is a viable solution? Please share your opinions in the comments section below.

Intel’s recent losses have undoubtedly raised concerns among investors and industry experts alike. The company, once a dominant force in the semiconductor industry, has been facing stiff competition from its rivals, particularly in the mobile and data center markets. The decline in Intel’s market share and financial performance has prompted the need for a strategic turnaround.

In response to these challenges, Intel has announced plans to invest heavily in domestic chip manufacturing. This move is aimed at reducing the company’s reliance on external foundries and regaining its technological leadership. By bringing chip production back in-house, Intel hopes to regain control over its supply chain and improve its ability to innovate.

Investing in domestic chip manufacturing certainly has its merits. It allows Intel to have greater control over the entire production process, from design to fabrication. This can result in faster time-to-market for new products, as well as better quality control. Additionally, having its own manufacturing facilities can provide Intel with a competitive advantage in terms of cost efficiency and flexibility.

However, there are also potential challenges and risks associated with this strategy. Building and operating state-of-the-art fabrication facilities requires significant capital investments, which could put a strain on Intel’s financial resources. Moreover, the semiconductor industry is highly complex and constantly evolving, with new technologies and manufacturing processes emerging regularly. Keeping up with these advancements and maintaining a competitive edge in the long term would require continuous investments in research and development.

Furthermore, investing in domestic chip manufacturing does not guarantee success. Intel will still need to address the underlying issues that have contributed to its recent losses, such as the delay in transitioning to smaller nanometer processes and the increasing competition from ARM-based processors. Without addressing these fundamental challenges, simply bringing chip production in-house may not be enough to turn the tide in Intel’s favor.

In conclusion, while investing in domestic chip manufacturing can be a viable solution for Intel, it is not without its challenges and risks. The company needs to carefully balance its investments in manufacturing capabilities with its efforts to address the underlying issues that have led to its recent setbacks. Only through a comprehensive and well-executed strategy can Intel hope to regain its position as a leader in the semiconductor industry.